Reporting Annual Interest Rate Charges on Loan Statements

In today's business world, compliance with legislation is not just a legal obligation, but a key factor in the growth and success of any enterprise. Businesses must stay up-to-date with the latest laws and regulations to thrive in this environment and ensure business practices align with them.

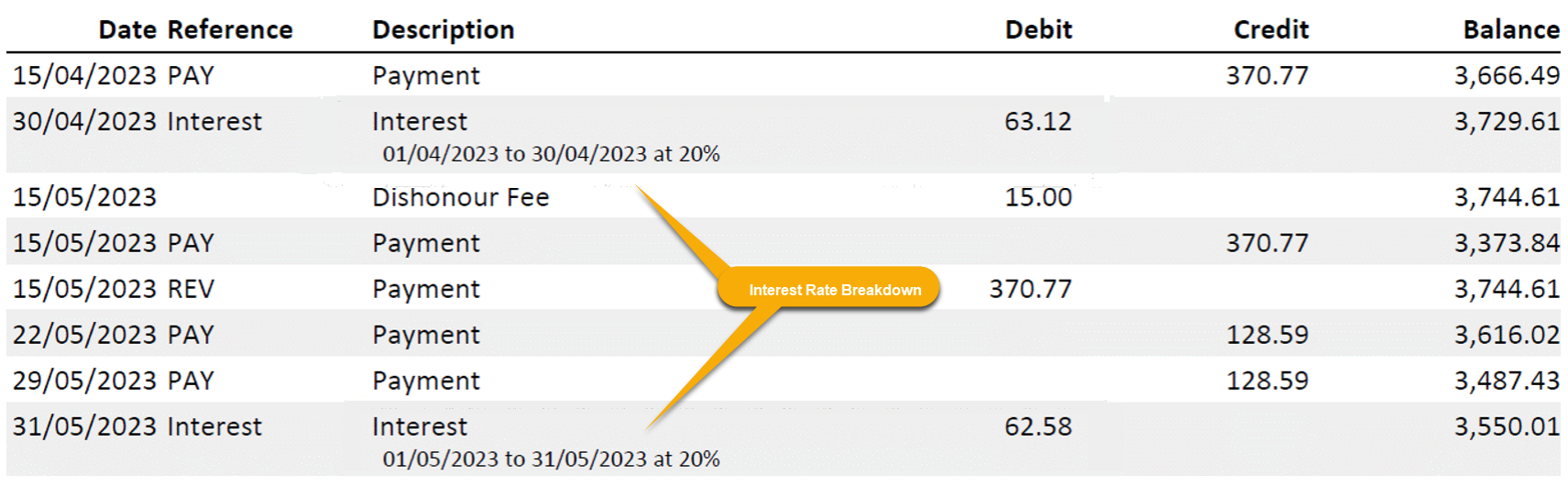

The Commerce Commission New Zealand advises that it is necessary to include a clear breakdown of Interest Rates on Loan Statements to help borrowers understand the true cost of their loans. This move towards greater transparency is a positive step in ensuring that borrowers are fully informed about the terms and conditions of their loans.

finPOWER Connect - Show Interest Rate Breakdown Settings

A constant in finPOWER Connect called

"ShowInterestRateBreakdown"

determines whether the Annual Interest Rate charge is included. By default, the constant is set to

"False", and needs to be updated to

"True"

to activate.

It is recommended that clients who use the Loan Statement run the latest version of finPOWER Connect and that the constant above is configured as

"True"

to comply with CCCFA regulations.

Although the Interest Rates might be listed on statements already, the Interest breakdown must be included, as demonstrated below.

For more information pertaining to the requirements of Annual Returns please review the below guidance document produced by the Commerce Commission New Zealand in April 2022.

At mbsl, we understand the significance of compliance and are committed to assisting our clients in achieving it. We strongly recommend that clients get in touch to obtain additional information about the Loan Statement document and its importance concerning CCCFA regulations.

Disclaimer

- This blog is intended as a guideline only. It is not definitive and should not be used as a substitute for legal advice. "Users" are solely responsible for staying up to date with legislative changes.

- It is the responsibility of "Users" of finPOWER Connect to ensure that the Statement format is suitable for their purposes.

Please Note:

- The content presented in this blog is current as of the date of publication. Please be aware that future legislative revisions could impact its accuracy.

- Some features mentioned in this blog might not be accessible in certain editions of finPOWER Connect. It is advised to contact mbsl to confirm the status of updates and for additional details.

Author - Kirsten Prime (mbsl) - 3 June 2024

Contact

mbsl to obtain additional information about the Loan Statement document and its importance concerning CCCFA regulations