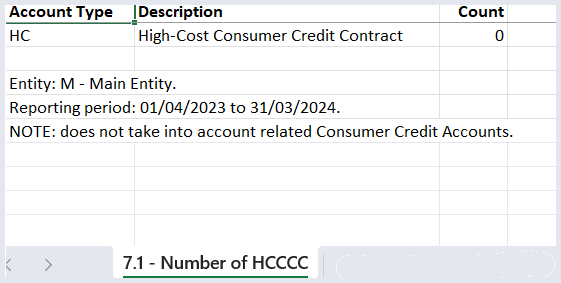

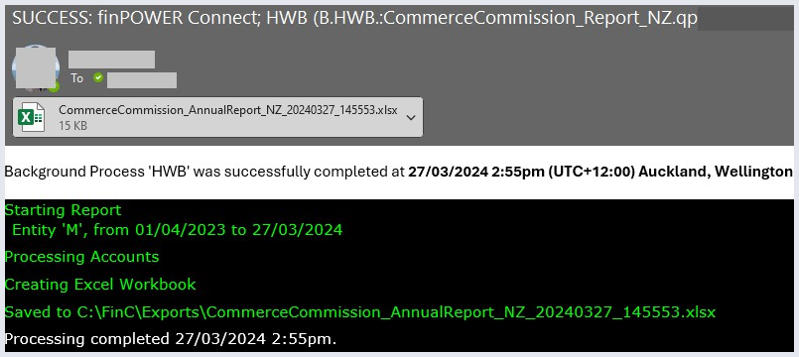

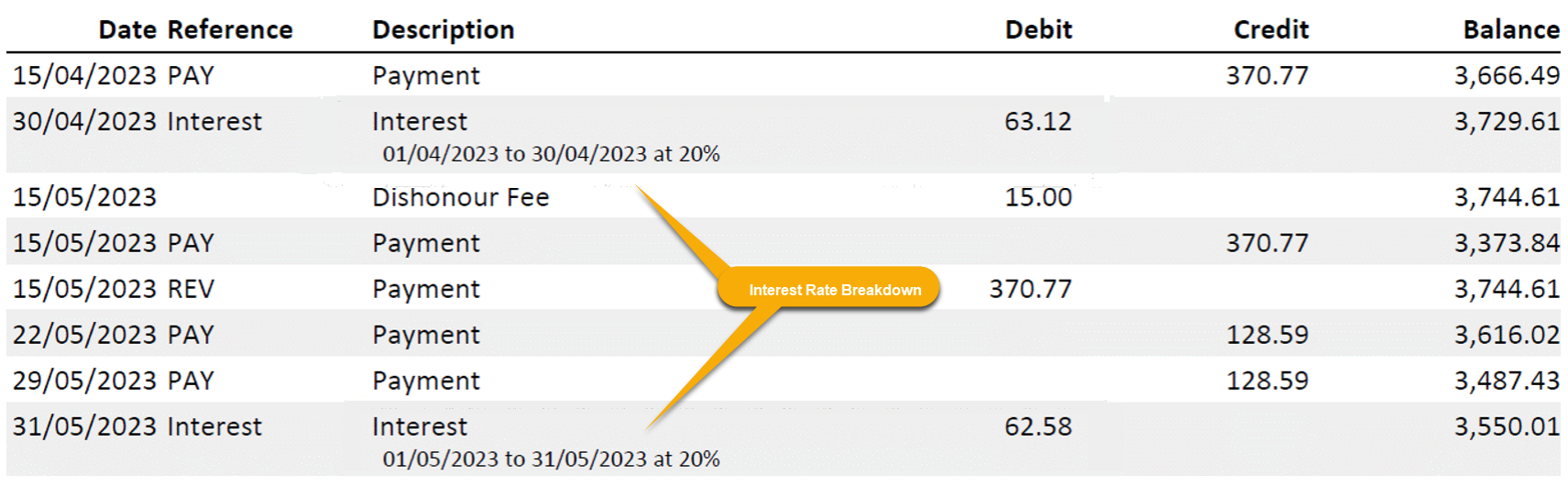

This list shows the number of High-Cost Consumer Loans opened in the reporting period, grouped by Account Type.

Count

The number of High-Cost loans in the Count is determined by accounts that fit the below criteria & were opened during the set Reporting Period.

- Account Class: All Loan classes.

- Credit Type: Consumer.

- Regulation: NZ High-Cost Consumer Credit Contract (as set on the account type).

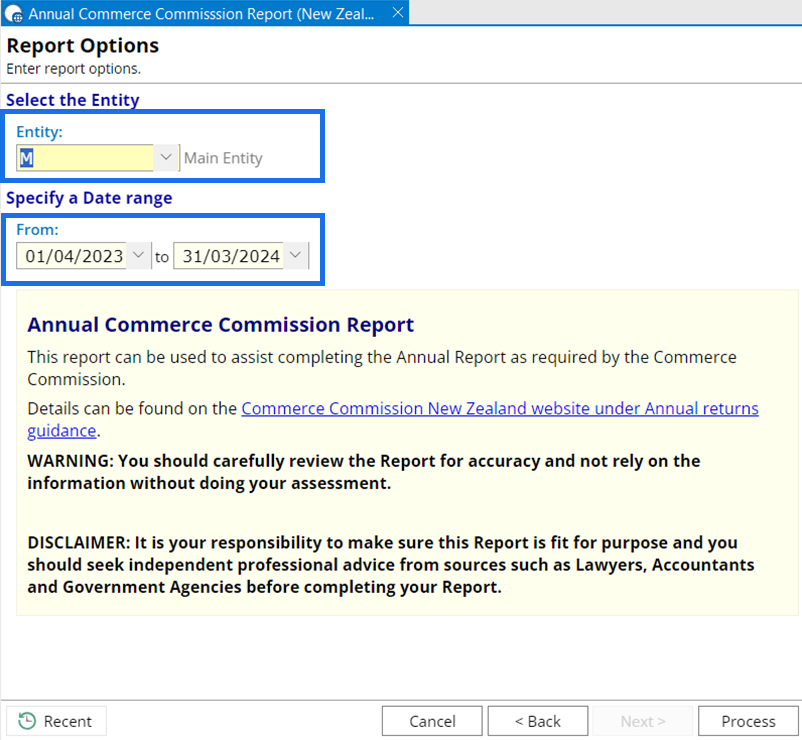

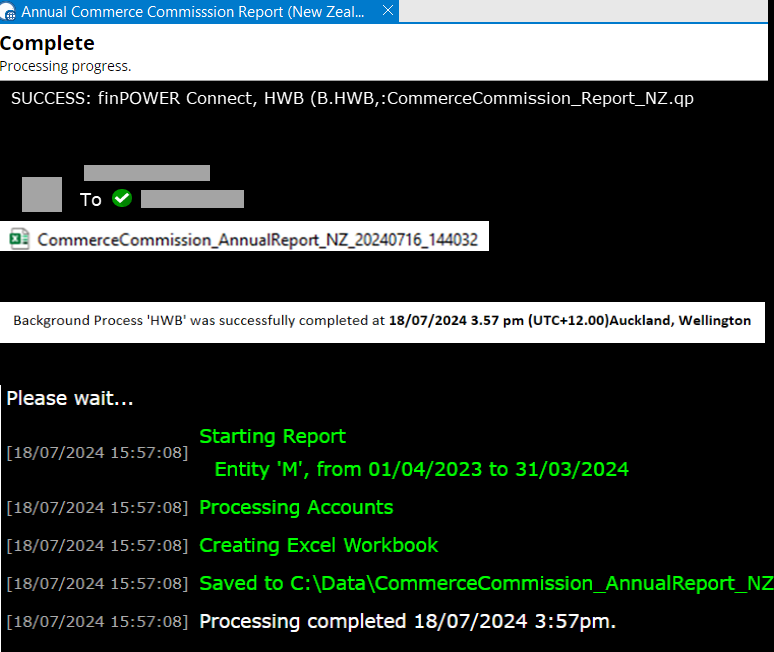

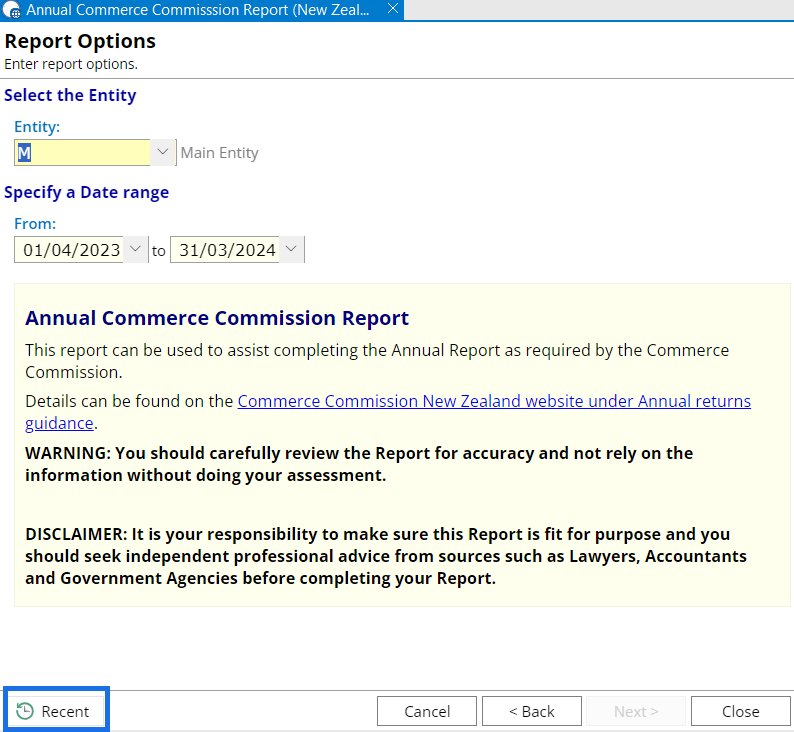

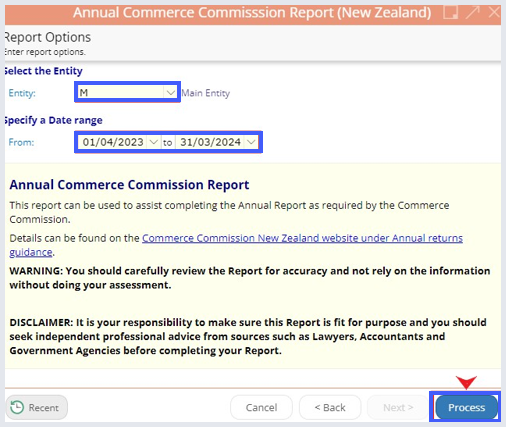

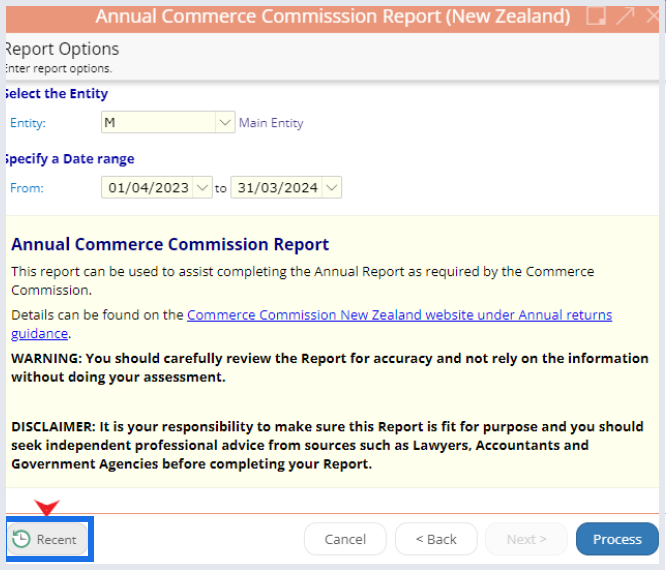

- Entity: As set by user.

- Reporting Period: As set by a user.

NB: does not take into account related Consumer Credit Accounts