finPOWER Connect -

Understanding the Comprehensive Credit Reporting Add-On

Overview

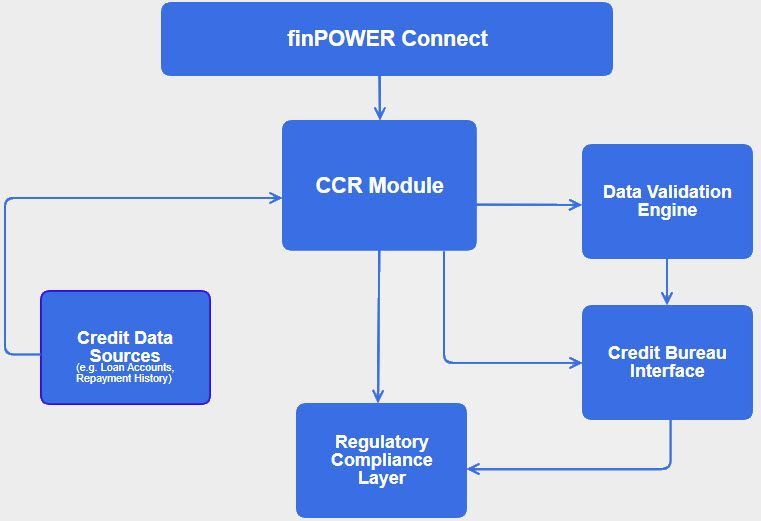

The Comprehensive Credit Reporting (CCR) Add-On in finPOWER Connect is designed to streamline the process of submitting credit data to credit bureaus.

It supports both the initial data load and the ongoing monthly reporting, helping lenders meet their compliance obligations efficiently.

The CCR Add-On is part of finPOWER Connect’s modular architecture, meaning it can be added to your existing system configuration. It works in harmony with other modules such as Loan Management and Collections,

ensuring a unified approach to account and data management.

Key Features

- Initial Data Load

- The CCR Add-On facilitates the first-time submission of customer credit data to a credit bureau.

- This includes historical account information, ensuring that the bureau has a complete picture of a borrower’s credit history.

- Monthly Periodic Reporting

- After the initial load, the module simplifies the monthly reporting process.

- It automates the generation and formatting of data files required by credit bureaus, reducing manual effort and minimizing errors.

- Routine Automation

- The CCR process is designed to become a monthly routine, integrating seamlessly into your operational workflow.

- This automation helps ensure timely and accurate reporting, which is critical for maintaining compliance and supporting responsible lending practices.

- Data Validation and Error Handling

- The module includes tools for validating data before submission.

- It flags inconsistencies or missing information, allowing users to correct issues before sending reports to the bureau.

- Compliance Support

- By aligning with industry standards for credit reporting, the CCR Add-On helps lenders stay compliant with regulatory requirements.

- It supports the principles of positive credit reporting, giving a more balanced view of a borrower’s creditworthiness.

Benefit for Lenders

- Efficiency

- Reduces the time and resources needed for credit reporting.

- Accuracy

- Minimizes errors through automated validation.

- Compliance

- Helps meet legal obligations with ease.

- Transparency

- Enhances the quality of data shared with credit bureaus, benefiting both lenders and borrowers.

Data Validation in the CCR Add-On

Accurate data is critical when reporting to credit bureaus, and finPOWER Connect’s CCR Add-On includes robust validation mechanisms to ensure data integrity before submission.

1. Built-In Validation Checks

The CCR module performs automatic checks on key data fields, including:

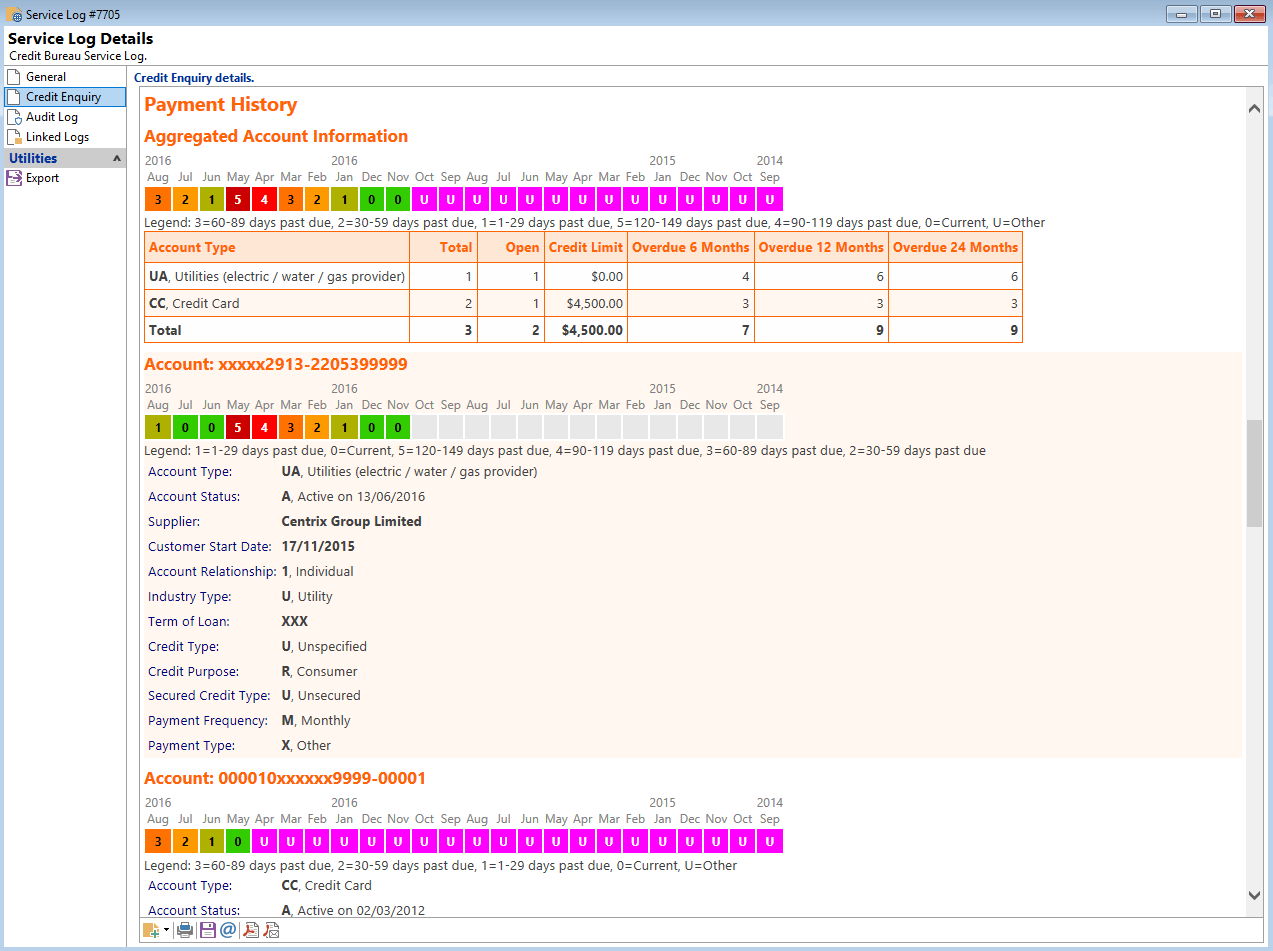

- Account Status

Ensures accounts are correctly classified (e.g., open, closed, defaulted).

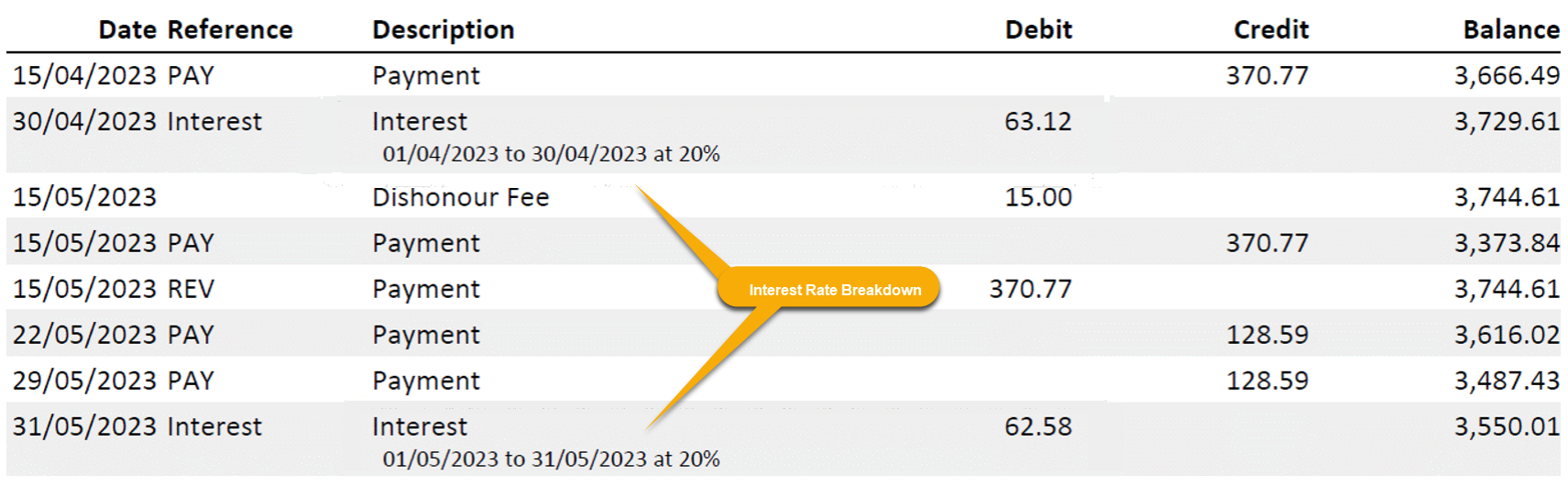

- Payment History:

Verifies that payment records are complete and formatted correctly.

- Client Identification:

Confirms that borrower details such as name, date of birth, and identification numbers are present and valid.

- Credit Limits and Balances:

Checks for consistency between reported credit limits, balances, and repayment amounts.

These checks help catch common errors such as missing fields, incorrect formats, or logical inconsistencies.

2. Custom Validation via Scripts

finPOWER Connect supports custom validation scripts through a feature called ExportValidate.

This script runs immediately before data is exported to the credit bureau and allows for tailored validation logic based on your business rules.

The script can:

- Flag specific records for review.

- Prevent export if critical errors are found.

- Provide detailed feedback on validation failures.

This flexibility ensures that lenders can adapt validation to meet both regulatory requirements and internal quality standards.

3. Error Reporting and Resolution

When validation fails:

- The system generates a detailed error report highlighting problematic records.

- Users can drill down into each issue, correct the data, and re-run validation.

- This iterative process ensures that only clean, compliant data is submitted.

4. Audit Trail

All validation actions are logged, providing a clear audit trail. This is useful for internal reviews and external compliance audits, demonstrating due diligence in data handling.

Source: Author - Kirsten Prime (mbsl) , 25 February 2025

Need mbsl to arrange a demonstration and/or assistance to install/update Postcodes and Addressing ?